Know your Customer (KYC)

Unblock offers its Merchants three levels of KYC and KYB process abstractions. The more abstraction you build, the better the UX for the Individual and Corporate going through the process.

Individuals require KYC on their second transactions or on higher value 1st transactions

An individual can use their Unblock bank account to do a fiatToCrypto or cryptoToFiat transaction right after user creation without needing to provide any KYC information.

Unblock only requires KYC on the second transaction or if the 1st transaction is >€700.

☝️Level 1: SDK and full delegation to Unblock

At this level, you can leverage the partnership between Unblock and Sumsub to gather identity and verification (IDV) documents from individuals extremely quickly, with very little development time.

The process is as follows:

- Create a user

- Create a KYC applicant using this endpoint

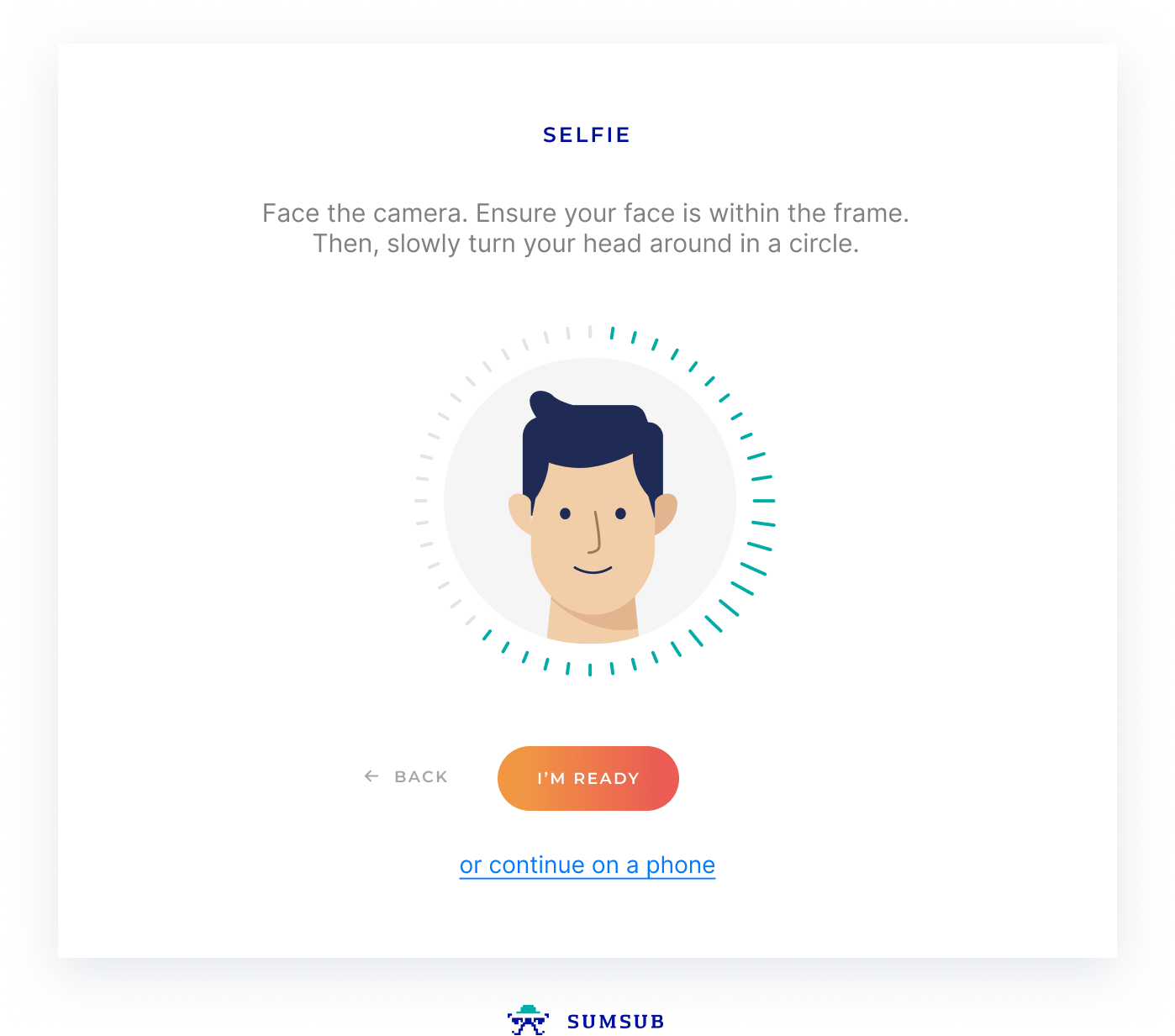

- Retrieve Sumsub SDK token using our endpoint

- Initiate the Sumsub SDK using the token

- This will initiate the SDK UI

- Once the Individual is done with the IDV collection, the Merchant will get a series of webhooks confirming the state of the KYC process and when the user is approved

✌️Level 2: The merchant already has the documents on file

Some merchants already collect IDV documents and keep them on file earlier in their process.

Sending these documents to Unblock would avoid asking the Individual again for them. Unblock will rescan the documents, and they will still go through the full KYC processes of Unblock.

Here are the steps to follow:

- Create a user

- Create a KYC applicant using this endpoint

- Upload the documents to Unblock using this endpoint; Unblock will need at least 1 ID document and at least one selfie.

- Once all documents are uploaded, start the KYC verification process using this endpoint

- Once the KYC process is completed on the Unblock systems, the Merchant will get a series of webhooks confirming the state of the KYC process and when the user is approved

✌️☝️Level 3: Full delegation to the Merchant

At this level, Unblock will fully rely on the KYC process and assessment of the Merchant. We will only do a random periodical audit of the Merchant processes to confirm that they still fit with the standard agreed in our commercial agreement.

This level does not require technical integration, as all the data and process stays on the Merchant side.

For Unblock to go through this assessment and discuss specifics, please get in touch with the onboarding team

KYC statuses

Users progress through various KYC states while applying. Every state has a distinct status. Merchants will be notified about any changes in a user's state and related data via our webhooks standards. Below are the definitions for each status.

KYC_NEEDED

This is when a user has gone over his no KYC limit and will go through the KYC process to be able to do more transactions.

PENDING_KYC_DATA

This is when a user has started the KYC Process, but we are still waiting on a few KYC documents to complete the verification.

KYC_PENDING

This is when a user has provided all the documents needed so far, and we are performing our KYC checks; this state can last between 10s and 5 minutes with an average of 1 minute.

SOFT_KYC_FAILED

This state is when a user has not passed our KYC checks but has a chance to correct the data or upload supporting documents for another try. There can be lots of different reasons that a user enters this state; these reasons will be sent as part of thedata key.

HARD_KYC_FAILED

This state is reached when a user has not passed our KYC checks, and we have decided we cannot serve this user. This could be for several reasons, but unfortunately, this decision is final. Reaching out to your Unblock support will not change this decision.

FULL_USER

Once all KYC checks have been submitted and passed, the user status changes to FULL_USER allowing them to transact without restriction.

No KYC limits

Unblock allows users to try out their portal without providing KYC information up to a certain limit.

This limit is set to a total value of 700 euro for one transaction of each type (fiatToCrypto or cryptoToFiat). Here is an example:

- Individual user signs up with Unblock and gets their Unblock bank account details

- The user sends 500 euros to his Unblock bank account to trigger a

fiatToCryptotransaction - [... time passes ...]

- The user comes back and sends 150 USDc to his Unblock wallet to trigger a

cryptoToFiattransaction. - At this point, the Individual has performed one transaction of each kind (

fiatToCryptoandcryptoToFiat) its status on this endpoint will returnKYC_NEEDED. The user can then go through one of the KYC flow described above

The same flow then above would happen if the user does an agregate value of transaction above 700 euros.

Updated about 1 year ago